Now Reading: Beginner's Guide To DeFi Platforms – 7 Steps To Navigate Cryptocurrency Trends

-

01

Beginner's Guide To DeFi Platforms – 7 Steps To Navigate Cryptocurrency Trends

Beginner's Guide To DeFi Platforms – 7 Steps To Navigate Cryptocurrency Trends

DeFi, or decentralized finance, is revolutionizing how you interact with financial services, providing access to an array of opportunities for wealth growth while exposing you to unique risks that require caution. In this guide, you’ll learn the vital steps to navigate the evolving landscape of DeFi platforms, ensuring you make informed decisions about your investments. From understanding the basic concepts to staying updated on trends, this comprehensive approach will empower you to utilize DeFi effectively and safely.

Key Takeaways:

- Understand DeFi: Familiarize yourself with the basics of Decentralized Finance, including its purpose and benefits compared to traditional finance.

- Research Platforms: Investigate various DeFi platforms available for trading, lending, and borrowing to find the ones that best fit your needs.

- Stay Informed: Keep up with the latest cryptocurrency trends and updates, as the DeFi space is rapidly evolving.

- Risk Management: Implement strategies to manage risks, such as diversifying your investments and using secure wallets.

- Engage with the Community: Join forums and discussion groups to learn from other users’ experiences and insights in the DeFi ecosystem.

Understanding DeFi Platforms

While the world of Decentralized Finance (DeFi) may seem complex, it’s built on the innovative philosophy of removing intermediaries in financial services. By leveraging blockchain technology, DeFi platforms aim to democratize access to financial products, lending users greater control over their assets and transactions. Understanding the core components of these platforms will help you navigate the rapidly evolving cryptocurrency landscape.

What is DeFi?

Understanding DeFi means grasping a financial ecosystem that operates without central authorities, using smart contracts to facilitate transactions. This technology allows users to trade, lend, and borrow directly from one another, promoting transparency and reducing fees. The result is a more inclusive financial system where anyone with an internet connection can participate.

Types of DeFi Platforms

You will encounter diverse DeFi platforms, each designed to serve different financial needs. Here are some key types:

- Lending Protocols – Allow users to lend and borrow assets.

- Decentralized Exchanges – Enable peer-to-peer trading of cryptocurrencies.

- Yield Farming – Users stake their assets to earn a return.

- Stablecoins – Cryptocurrencies pegged to traditional assets.

- Insurance Platforms – Provide coverage against financial risks.

After exploring these types, you will have a clearer picture of how different DeFi solutions can cater to your financial goals.

| Type of DeFi Platform | Description |

|---|---|

| Lending Protocols | Facilitate loans and earn interest. |

| Decentralized Exchanges | Enable trading without intermediaries. |

| Yield Farming | Stake assets for passive income. |

| Stablecoins | Mitigate volatility with price stability. |

| Insurance Platforms | Protect assets from potential loss. |

What you should know is that each type of DeFi platform offers unique benefits. For instance, lending platforms often provide higher potential returns than traditional banks, while decentralized exchanges offer reduced risks associated with centralized control. Engaging with these platforms means you’re participating in a revolution in finance, but be aware of the associated risks and volatility within the crypto space. Your careful approach can enhance your experience in DeFi.

- Diversification – Consider various platforms to spread your risk.

- Risk Management – Research before investing.

- Liquidity Pools – Understand how they work for better returns.

- Impermanent Loss – Know the risks if providing liquidity.

- Network Security – Choose only reputable platforms.

After gathering this information, you will be better equipped to make informed decisions about your involvement in the world of DeFi.

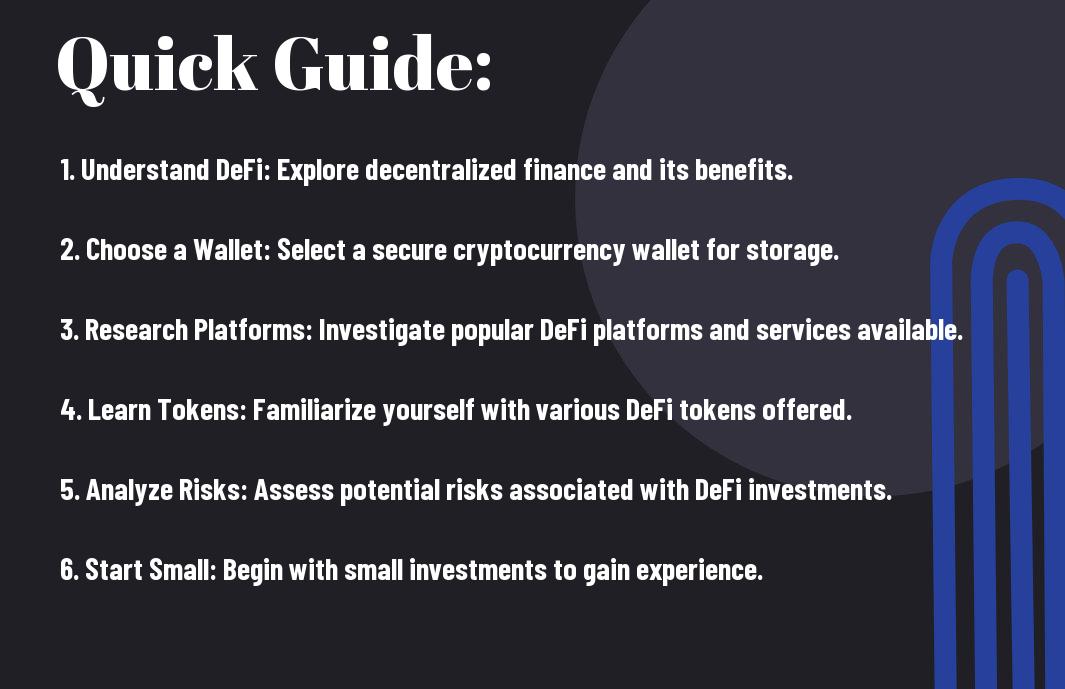

Step-by-Step Guide to Navigating DeFi

Now that you’ve decided to explore into the world of DeFi, navigating its complexities can seem overwhelming. However, breaking it down into manageable steps will help you make the most informed decisions. Below is a straightforward guide to assist you in your journey:

| Step | Action |

|---|---|

| 1 | Research various DeFi platforms |

| 2 | Compare fees and features |

| 3 | Choose the right platform |

| 4 | Set up your digital wallet |

| 5 | Fund your wallet with cryptocurrency |

| 6 | Explore investment options |

| 7 | Monitor your investments |

Choosing the Right Platform

There’s an abundance of DeFi platforms available, and selecting the right one is key to a successful experience. Assess their reputation, security measures, and user interface to ensure they align with your goals and comfort level. Additionally, consider the available features, such as liquidity pools and lending services, to maximize your potential returns.

Setting Up Your Wallet

Right from the start, establishing a secure digital wallet is imperative for managing your cryptocurrencies effectively. Your wallet acts as the gateway to the DeFi space, allowing you to send, receive, and store assets safely. Make sure to choose a reputable wallet that you feel comfortable with and that has strong security features.

DeFi platforms largely hinge on the use of digital wallets. A secure wallet is critical in protecting your assets from potential threats like hacks or inadvertent loss. Look for wallets that incorporate two-factor authentication and backup options. Also, ensure you keep your private keys safe; losing them can result in losing access to your funds permanently. Selecting a wallet that aligns with the DeFi platforms you wish to use will enhance your overall experience.

Key Factors to Consider

Unlike traditional finance, navigating DeFi platforms requires you to evaluate several key factors that can impact your experience and potential returns. Consider the following:

- Security protocols in place

- User experience and interface

- Liquidity options available

- Fees associated with transactions

- Community engagement and support

Assume that each of these elements plays a significant role in your success within the DeFi landscape.

Security Measures

Any DeFi platform you engage with should implement robust security measures to protect your assets. Check for features like smart contract audits, multi-signature wallets, and compliance with industry standards to minimize risks. The presence of a transparent security protocol can provide you with assurance that your investments are safeguarded against potential threats.

User Experience

Measures taken to enhance user experience can significantly influence your interaction with DeFi platforms. The interface should be intuitive and streamlined, making it easier for you to navigate and execute transactions. Additionally, responsiveness of the customer support team can affect how quickly you resolve issues, so opt for platforms with strong community feedback and support systems.

With various platforms prioritizing user experience, you’ll find some offering educational resources and user-friendly dashboards designed to simplify your journey. A clean interface will help you manage your investments more effectively, while responsive support can guide you through potential challenges. However, lack of clarity or rigorous onboarding processes can lead to frustration, particularly for newcomers. Ensure that the platform you choose maintains a balance between aesthetic design and functional efficiency to support your DeFi ambitions.

Tips for Beginners

To successfully navigate the world of DeFi, consider these necessary tips:

- Educate yourself about DeFi platforms.

- Practice safe cryptocurrency trading.

- Utilize reputable exchanges.

- Diversify your investments.

- Engage with the crypto community.

After following these tips, you can enhance your understanding and experience in the decentralized finance space. For more insights, check out A Beginner’s Guide to Decentralised Finance (DeFi) – M2.

Start Small

While entering the DeFi space, it’s wise to start with a manageable investment. Begin with a small amount that fits your budget and allows you to familiarize yourself with various platforms and transactions without risking significant financial loss. This approach will help you gain confidence while learning the dynamics of DeFi.

Stay Updated

Stay on top of the latest developments in the DeFi arena to make informed decisions. Monitoring news sources, joining social media groups, and subscribing to cryptocurrency newsletters can provide you with crucial insights into market movements and trends. Engaging with thought leaders and participating in discussions will enhance your understanding of potential risks and rewards in this rapidly evolving sector.

Start by regularly checking reliable sources and following key influencers in the DeFi space. This way, you can track emerging trends and potential threats, such as scams or market downturns. Actively participating in community forums can also provide exposure to real-time feedback and invaluable experience. As you stay informed, your ability to make decisions and navigate the crypto market will improve significantly.

Pros and Cons of DeFi

Despite the rapid growth of decentralized finance (DeFi), it comes with both benefits and drawbacks that you should consider before diving in. Below is a breakdown of the pros and cons of DeFi to help you navigate this complex space.

| Pros | Cons |

|---|---|

| Accessibility | Potential for loss of funds |

| Transparency | Smart contract vulnerabilities |

| High yields | Regulatory risks |

| No intermediaries | Complexity of use |

| Global reach | Market volatility |

| Flexibility and innovation | Limited customer support |

Advantages of Using DeFi

The advantages of using DeFi platforms are significant. You can access financial services without traditional banking systems, providing greater autonomy over your assets. DeFi offers high returns through yield farming and liquidity provision, while its transparency allows you to track transactions openly. Additionally, you gain access to a global market, enabling a diverse range of financial opportunities.

Disadvantages to Be Aware Of

On the other hand, there are notable disadvantages to using DeFi that you must be aware of. These include risks such as potential loss of funds due to scams or hacks, as well as the technical complexities that can make participation difficult for newcomers.

It is important to understand that while DeFi platforms can offer high rewards, the risks are equally significant. You face the danger of losing your funds through smart contract bugs or fraudulent schemes. Furthermore, the regulatory landscape is uncertain, which can lead to abrupt changes affecting your investments. Always perform thorough research and exercise caution when engaging with DeFi platforms.

Final Words

Summing up, your journey into the world of DeFi platforms can be simplified through these 7 imperative steps. By following this beginner’s guide, you can effectively navigate the evolving trends in cryptocurrency and take control of your financial future. For further insights and a comprehensive understanding, check out A Beginner’s Guide to Decentralized Finance (DeFi). Embrace the opportunities that DeFi offers, and empower yourself in this transformative landscape.

FAQ

Q: What is DeFi, and how does it differ from traditional finance?

A: Decentralized Finance (DeFi) refers to financial services that operate on blockchain technology without intermediaries, like banks. Unlike traditional finance, which involves centralized institutions that can control transactions and access to services, DeFi platforms use smart contracts to automate processes. This enables users to engage in activities like lending, borrowing, and trading directly with one another, often with lower fees and greater transparency.

Q: What are the basic steps to get started with DeFi platforms?

A: To start using DeFi platforms, you can follow these steps: 1) Educate yourself about DeFi and its risks. 2) Set up a cryptocurrency wallet that supports DeFi tokens. 3) Purchase some cryptocurrency to use on DeFi platforms. 4) Choose a DeFi platform relevant to your needs, such as lending, exchanging, or yield farming. 5) Connect your wallet to the platform. 6) Familiarize yourself with the platform’s features. 7) Start engaging with the services offered while monitoring your investments.

Q: How can I evaluate the safety of a DeFi platform?

A: To assess the safety of a DeFi platform, consider several factors: check the project’s audit history for any security vulnerabilities, review user feedback and the platform’s community engagement, and investigate the team behind the project to gauge their experience and reputation. Additionally, ensure the platform has transparency in terms of code and operations, and consider using platforms that have been operational for a longer duration, as they tend to have established security measures.

Q: What should I know about cryptocurrency wallets and their types before participating in DeFi?

A: Cryptocurrency wallets are important for interacting with DeFi platforms. There are two main types: hot wallets, which are connected to the internet and offer convenience for regular transactions, and cold wallets, which are offline and provide better security for long-term storage. When choosing a wallet, consider factors such as ease of use, compatibility with DeFi platforms, and security features. Wallets like MetaMask or hardware wallets like Ledger are popular choices among DeFi users.

Q: What are the common risks associated with using DeFi platforms?

A: Engaging with DeFi platforms comes with several risks. These include market volatility, which can lead to significant losses, the possibility of smart contract bugs or exploits that can result in loss of funds, and the risk of scams or fraudulent projects. Additionally, because DeFi is relatively new, regulatory changes could impact operations. It is advisable to conduct thorough research and only invest what you can afford to lose.